Understanding Bank Holidays and Their Impact on HMRC Operations in 2025

Related Articles: Understanding Bank Holidays and Their Impact on HMRC Operations in 2025

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Understanding Bank Holidays and Their Impact on HMRC Operations in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Understanding Bank Holidays and Their Impact on HMRC Operations in 2025

- 2 Introduction

- 3 Understanding Bank Holidays and Their Impact on HMRC Operations in 2025

- 3.1 Bank Holidays in 2025: A Comprehensive Overview

- 3.2 The Impact of Bank Holidays on HMRC Operations

- 3.3 Planning Ahead: Ensuring Smooth Interactions with HMRC

- 3.4 FAQs Regarding Bank Holidays and HMRC

- 3.5 Conclusion: Navigating Bank Holidays and HMRC Interactions

- 4 Closure

Understanding Bank Holidays and Their Impact on HMRC Operations in 2025

The United Kingdom observes a number of public holidays each year, commonly referred to as bank holidays. These days are designated as non-working days, impacting various services, including those provided by Her Majesty’s Revenue and Customs (HMRC). Understanding the dates and implications of bank holidays in 2025 is crucial for individuals and businesses interacting with HMRC.

Bank Holidays in 2025: A Comprehensive Overview

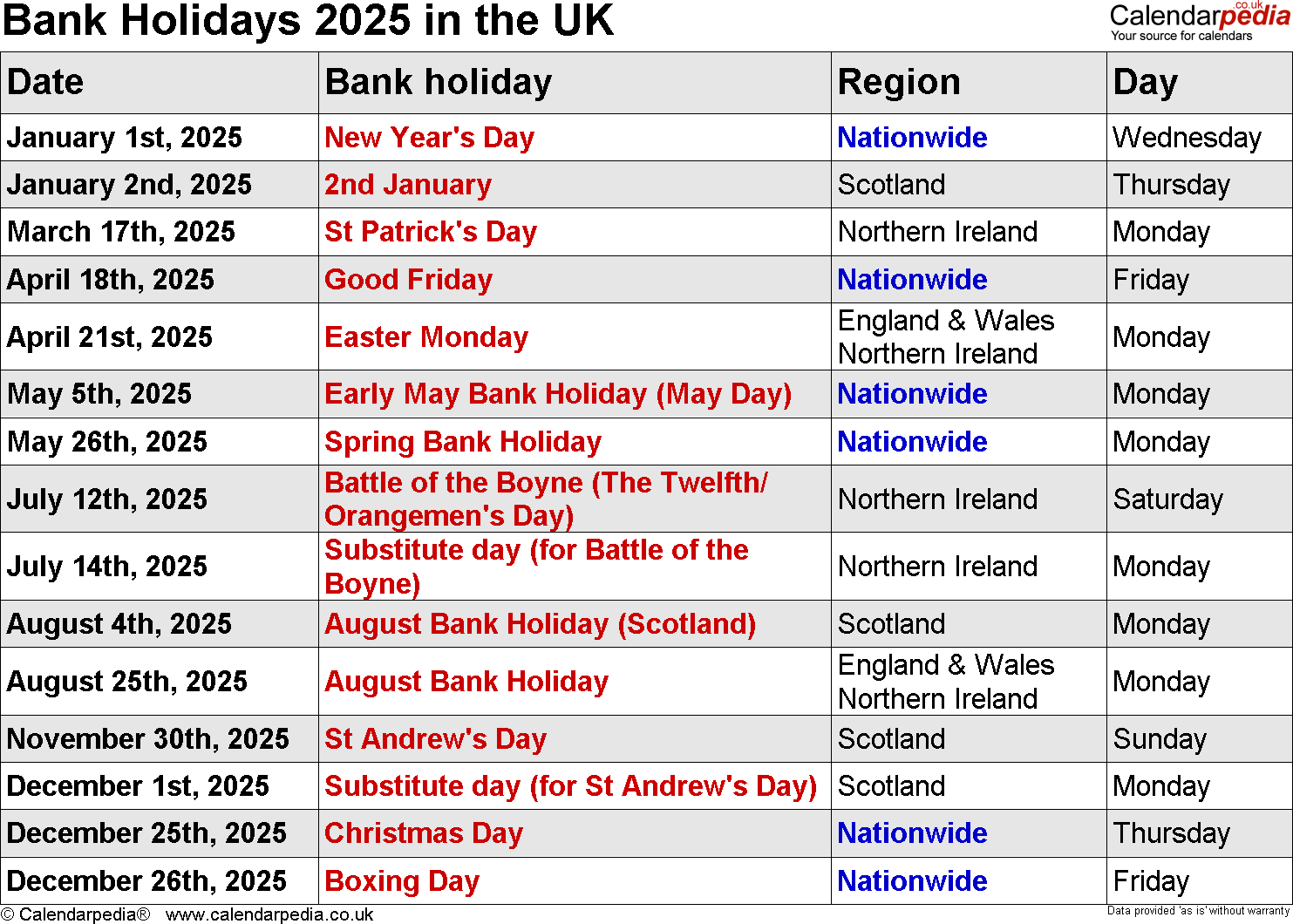

The specific dates for bank holidays in 2025 are subject to confirmation. However, based on historical trends and established patterns, it is anticipated that the following days will be designated as bank holidays:

- New Year’s Day: January 1st (Wednesday)

- Good Friday: March 28th (Friday)

- Easter Monday: March 31st (Monday)

- Early May Bank Holiday: May 6th (Monday)

- Spring Bank Holiday: May 27th (Monday)

- Summer Bank Holiday: August 25th (Monday)

- Christmas Day: December 25th (Wednesday)

- Boxing Day: December 26th (Thursday)

It is important to note that these dates are tentative and subject to change. Official confirmation will be provided by the UK government in due course.

The Impact of Bank Holidays on HMRC Operations

Bank holidays have a significant impact on HMRC operations, primarily due to the closure of physical offices and the suspension of certain online services. This can affect:

- Tax Payment Deadlines: Tax payments due on a bank holiday are generally moved to the next working day. For example, if a tax payment is due on a Monday that is a bank holiday, the deadline will shift to the following Tuesday.

- HMRC Contact Centre Availability: Contact centres may operate with reduced hours or be completely closed on bank holidays. This can lead to longer wait times for assistance or limited availability of services.

- Online Service Accessibility: While most online services remain accessible, some functionalities may be limited or unavailable on bank holidays. This can affect tasks such as filing tax returns, managing tax accounts, or accessing personal tax information.

- Processing Times: The processing of tax returns, refunds, and other HMRC transactions may be delayed during bank holidays.

Planning Ahead: Ensuring Smooth Interactions with HMRC

To mitigate potential disruptions, it is essential to plan ahead and be aware of the impact of bank holidays on HMRC operations. Individuals and businesses should:

- Check Payment Deadlines: Verify the deadline for tax payments and ensure they are made well in advance of any potential bank holidays to avoid late penalties.

- Utilize Online Services: Take advantage of HMRC’s online services, which are generally available even during bank holidays, to manage tax-related matters.

- Contact HMRC Early: If contacting HMRC is necessary, do so well in advance of any bank holidays to avoid potential delays.

- Stay Informed: Monitor official HMRC announcements and websites for updates regarding bank holiday closures and service disruptions.

FAQs Regarding Bank Holidays and HMRC

Q: What happens if a tax payment is due on a bank holiday?

A: Tax payments due on a bank holiday are generally moved to the next working day.

Q: Are HMRC offices closed on bank holidays?

A: Yes, HMRC offices are generally closed on bank holidays.

Q: Can I access HMRC online services on bank holidays?

A: Most online services remain accessible, but some functionalities may be limited or unavailable.

Q: Will HMRC processing times be affected by bank holidays?

A: Yes, processing times for tax returns, refunds, and other transactions may be delayed.

Q: How can I stay informed about bank holiday closures and service disruptions?

A: Monitor official HMRC announcements and websites for updates.

Conclusion: Navigating Bank Holidays and HMRC Interactions

Understanding the impact of bank holidays on HMRC operations is crucial for individuals and businesses seeking to ensure smooth interactions with the tax authority. By planning ahead, utilizing online services, and staying informed, individuals and businesses can navigate bank holidays effectively and avoid potential disruptions to their tax-related matters. It is important to remember that while bank holidays offer a welcome break for many, they can also necessitate adjustments to tax-related activities. By staying informed and proactive, individuals and businesses can ensure their interactions with HMRC remain seamless throughout the year.

Closure

Thus, we hope this article has provided valuable insights into Understanding Bank Holidays and Their Impact on HMRC Operations in 2025. We thank you for taking the time to read this article. See you in our next article!