Navigating US Banking Holidays in 2025: A Comprehensive Guide

Related Articles: Navigating US Banking Holidays in 2025: A Comprehensive Guide

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating US Banking Holidays in 2025: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating US Banking Holidays in 2025: A Comprehensive Guide

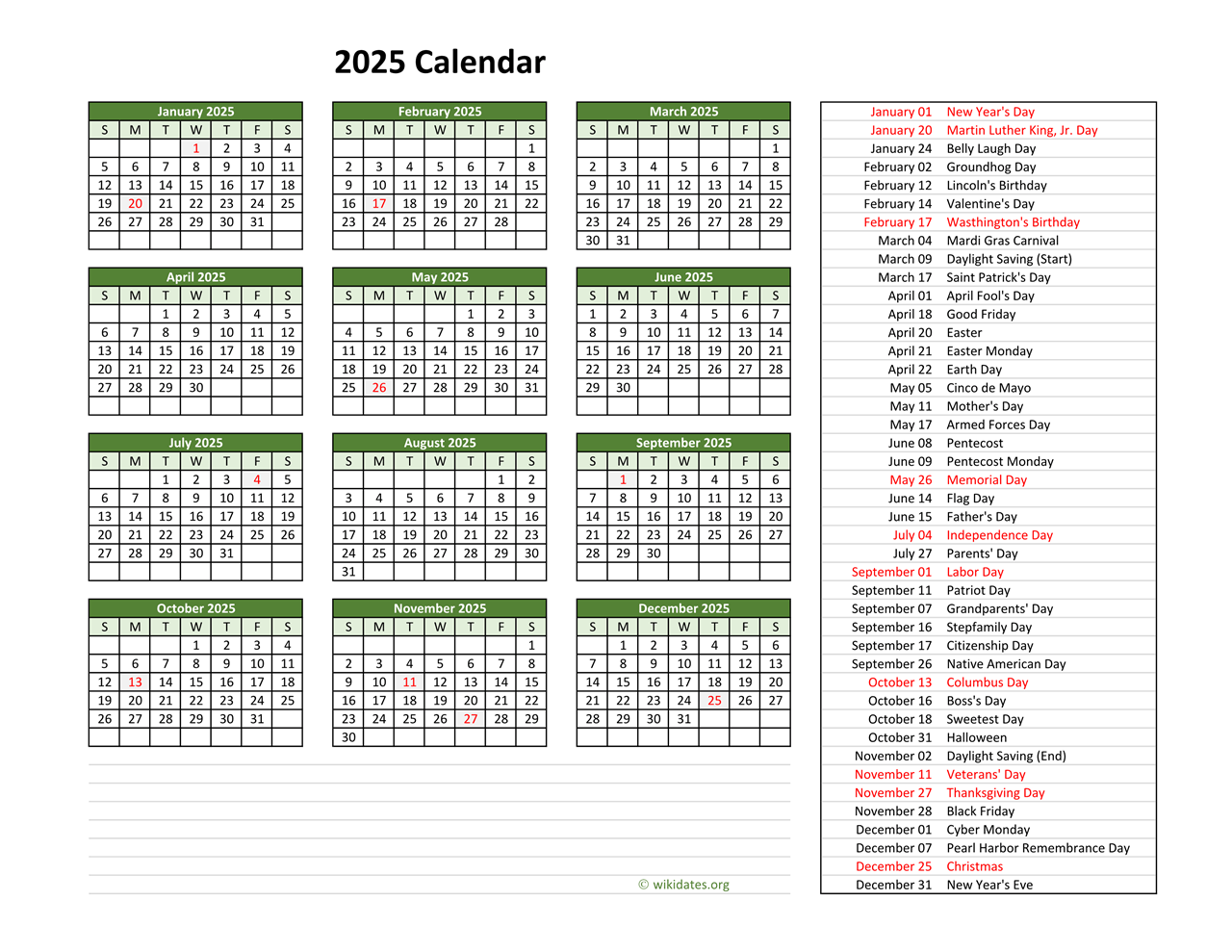

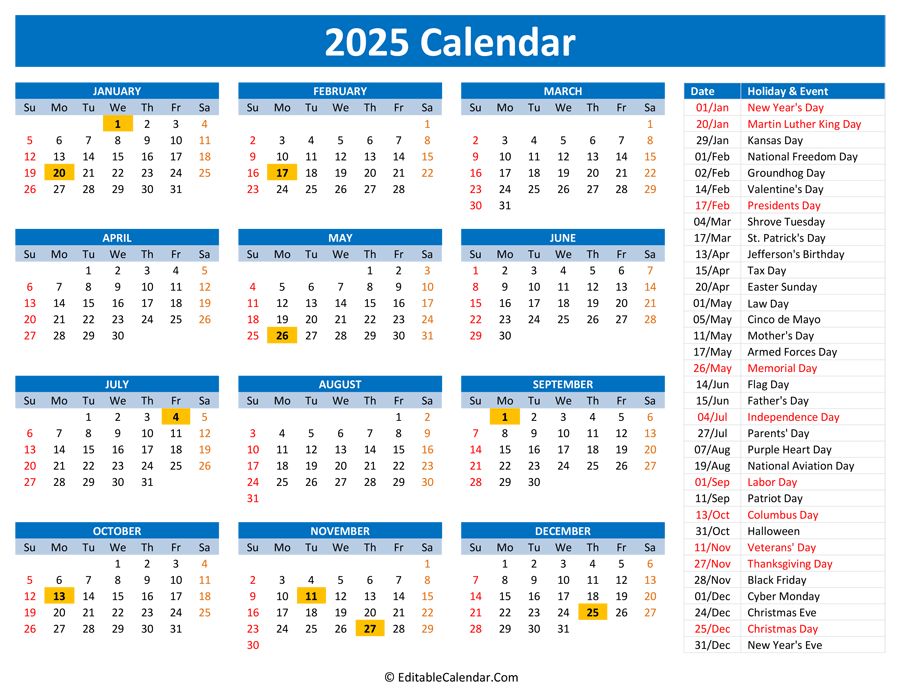

The year 2025 presents a unique set of circumstances for understanding US banking holidays. While the traditional holidays remain consistent, the calendar’s layout introduces several nuances that impact financial planning and transactions. This comprehensive guide provides an in-depth analysis of US banking holidays in 2025, clarifying their significance and offering valuable insights for navigating financial activities throughout the year.

Understanding US Banking Holidays: A Foundation

US banking holidays are designated days when banks are closed for business, affecting various financial services like check processing, wire transfers, and loan payments. These closures are rooted in federal and state laws, recognizing the importance of commemorating national events and providing employees with time for rest and reflection.

2025: A Year with Unique Considerations

2025 presents a few unique aspects related to banking holidays. Firstly, the calendar’s layout positions certain holidays close to weekends, potentially extending closures. Secondly, the increasing adoption of digital banking and mobile payment systems has introduced new dynamics to navigating holiday-related financial transactions.

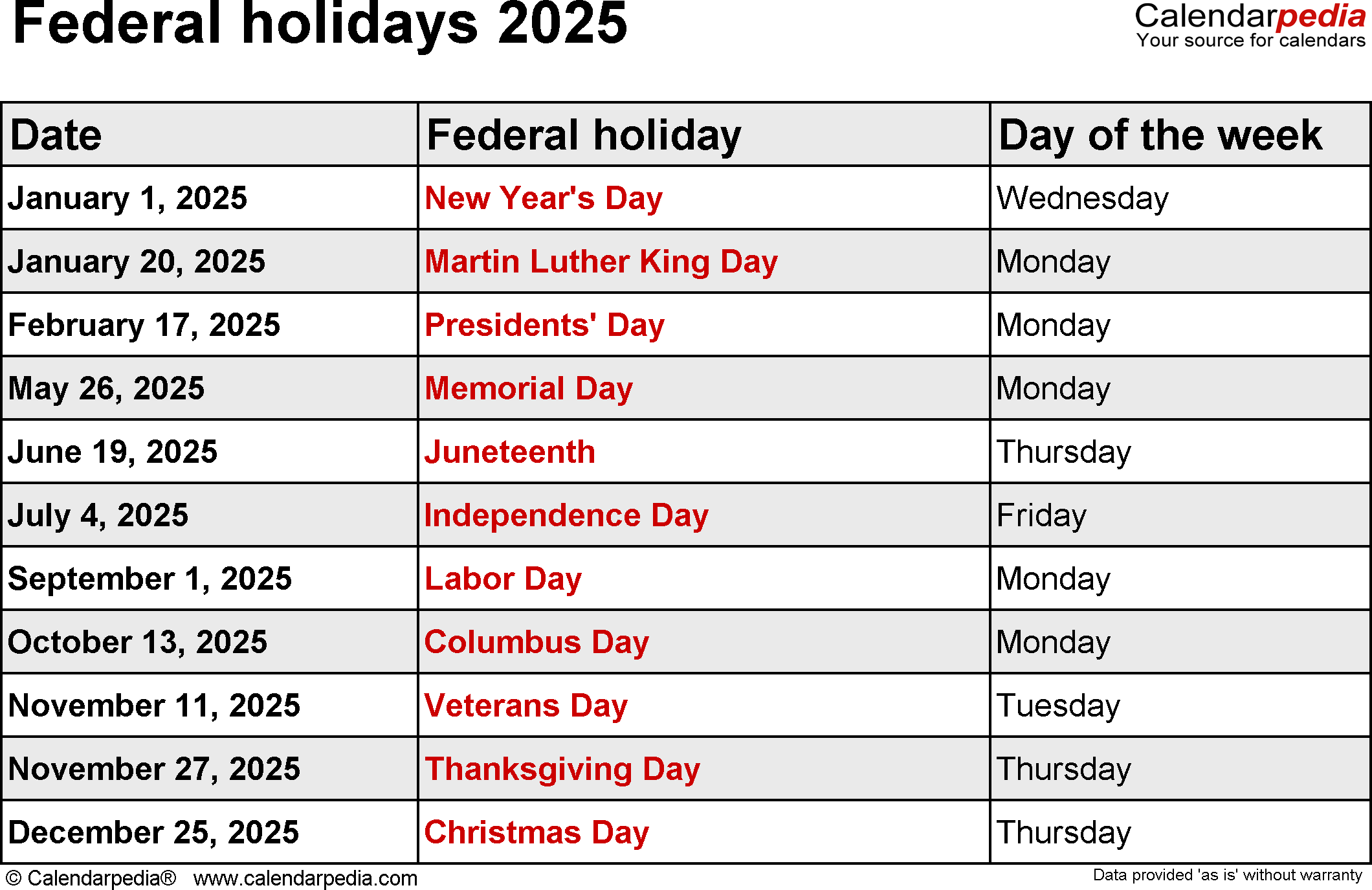

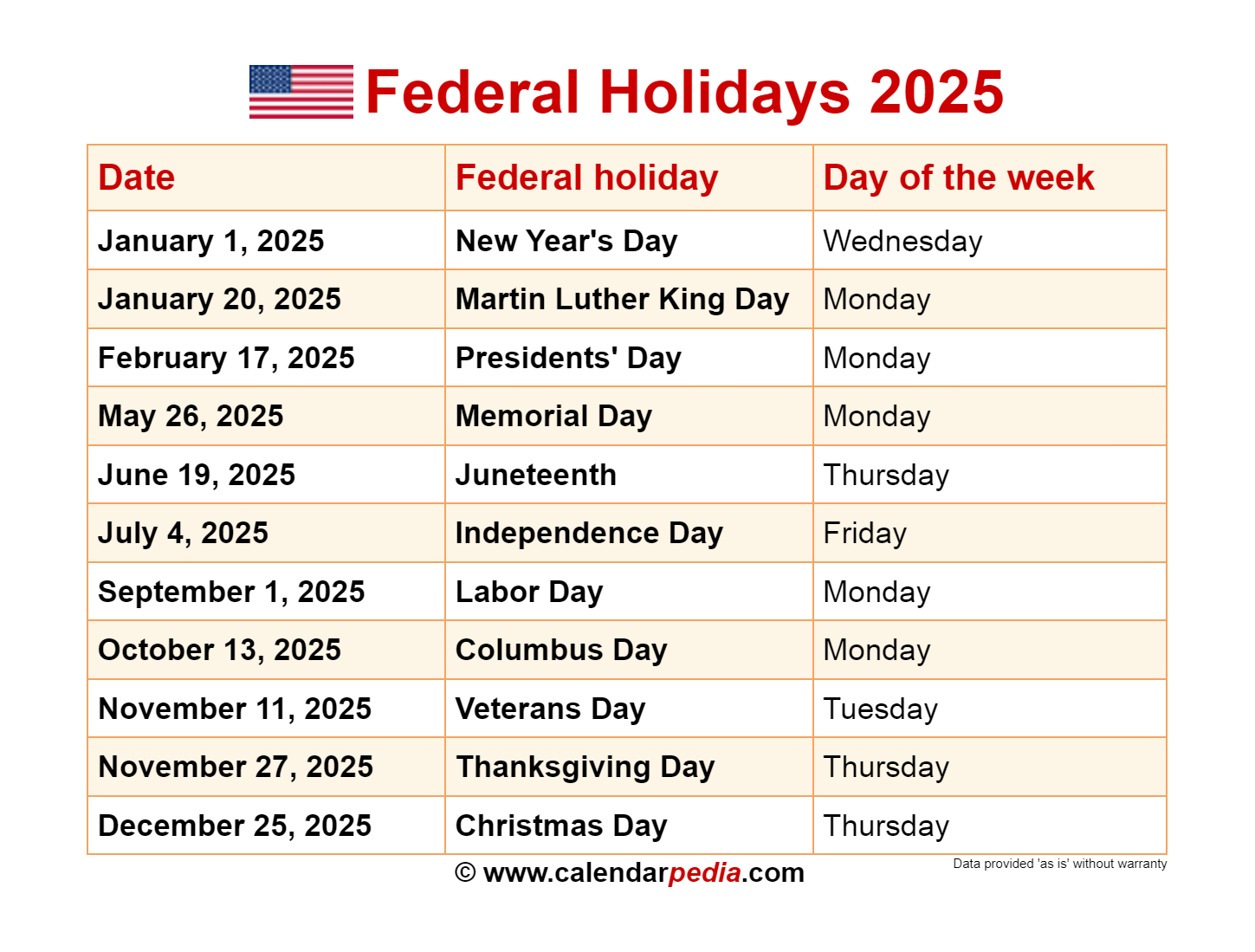

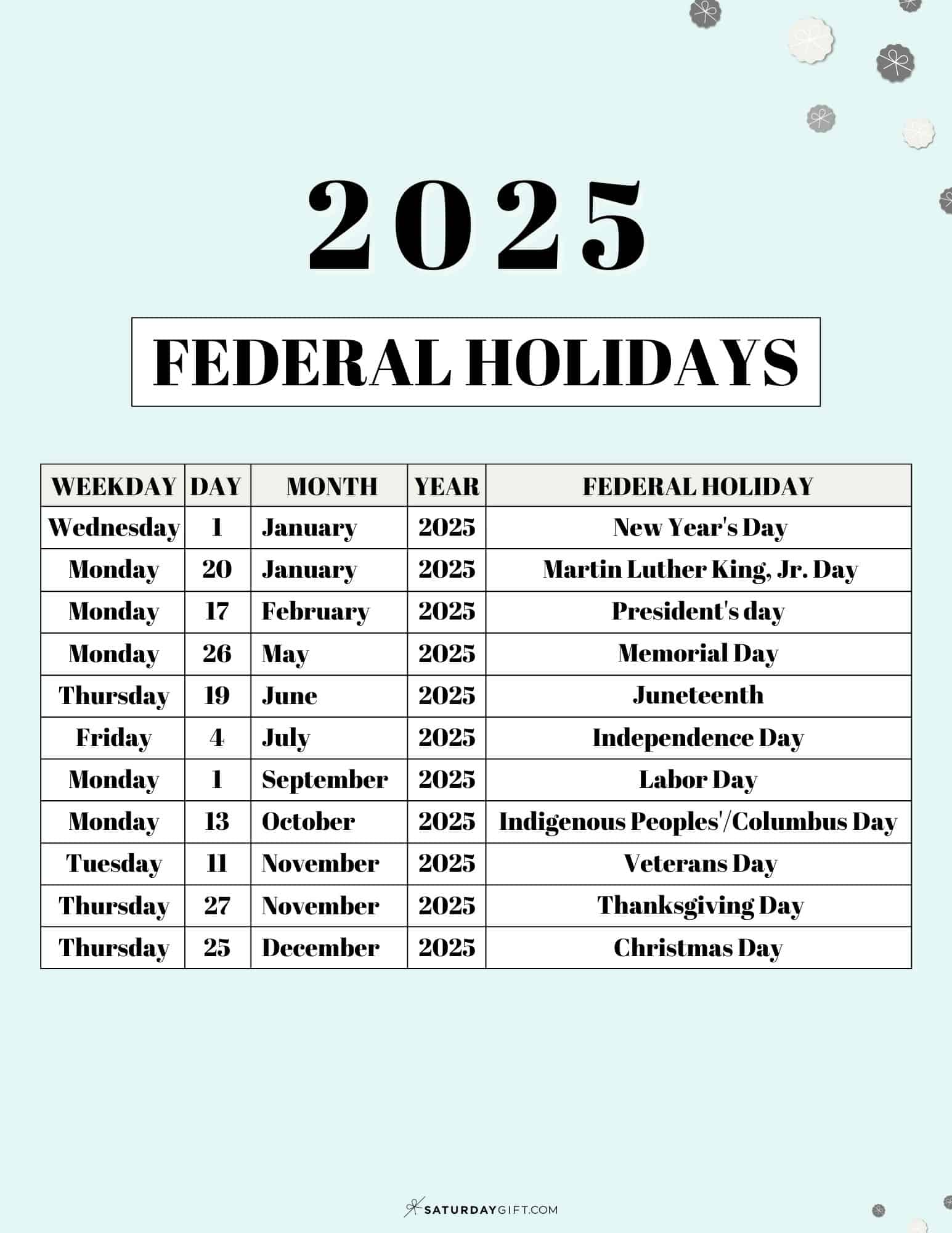

A Detailed Look at the US Banking Holidays in 2025:

The following table provides a comprehensive list of US banking holidays in 2025, outlining their dates, significance, and potential impact on financial services:

| Date | Holiday | Significance | Potential Impact on Financial Services |

|---|---|---|---|

| January 1 | New Year’s Day | Celebrates the beginning of a new year. | Most banks closed. Check processing, wire transfers, and loan payments may be delayed. |

| January 20 | Martin Luther King Jr. Day | Honors the life and legacy of civil rights leader Martin Luther King Jr. | Most banks closed. Check processing, wire transfers, and loan payments may be delayed. |

| February 17 | Presidents’ Day | Celebrates the birthdays of George Washington and Abraham Lincoln. | Most banks closed. Check processing, wire transfers, and loan payments may be delayed. |

| May 26 | Memorial Day | Honors those who died while serving in the United States Armed Forces. | Most banks closed. Check processing, wire transfers, and loan payments may be delayed. |

| July 4 | Independence Day | Celebrates the signing of the Declaration of Independence. | Most banks closed. Check processing, wire transfers, and loan payments may be delayed. |

| September 1 | Labor Day | Celebrates the contributions of workers to the economy. | Most banks closed. Check processing, wire transfers, and loan payments may be delayed. |

| October 13 | Columbus Day | Celebrates the arrival of Christopher Columbus in the Americas. | Most banks closed. Check processing, wire transfers, and loan payments may be delayed. |

| November 11 | Veterans Day | Honors those who served in the United States Armed Forces. | Most banks closed. Check processing, wire transfers, and loan payments may be delayed. |

| November 28 | Thanksgiving Day | Celebrates the harvest and the arrival of the Pilgrims in America. | Most banks closed. Check processing, wire transfers, and loan payments may be delayed. |

| December 25 | Christmas Day | Celebrates the birth of Jesus Christ. | Most banks closed. Check processing, wire transfers, and loan payments may be delayed. |

Important Considerations:

- Weekend Closures: Pay close attention to holidays that fall close to weekends, as banks may extend their closures. For example, if a holiday falls on a Friday, banks might remain closed on the following Saturday.

- Regional Variations: While most federal holidays are observed nationwide, some state and local holidays may also impact banking operations in specific regions.

- Digital Banking: The rise of digital banking platforms has provided greater flexibility in managing finances during holidays. Many banks offer online and mobile banking services that allow customers to access accounts and perform transactions even during closures.

- Check Processing: Be aware that check processing may be delayed during holidays, potentially impacting payments and deposits. Plan accordingly and consider alternative payment methods like online transfers or mobile wallets.

Benefits of Understanding Banking Holidays:

- Financial Planning: Knowing the dates of upcoming banking holidays allows for better financial planning, ensuring timely payments and avoiding potential disruptions.

- Avoiding Inconvenience: Understanding the potential impact of banking closures can help individuals avoid unnecessary trips to banks and ensure smooth financial transactions.

- Leveraging Digital Services: The knowledge of banking holidays encourages individuals to utilize digital banking services, offering greater flexibility and convenience.

Frequently Asked Questions:

Q: Are all banks closed on US banking holidays?

A: While most banks observe federal holidays, some smaller institutions or credit unions may have different operating hours. It’s essential to contact your specific bank to confirm their holiday schedule.

Q: Can I deposit checks during a banking holiday?

A: Most banks have ATMs and night deposit boxes that allow deposits even when the branch is closed. However, check processing may be delayed, so it’s advisable to deposit checks well in advance of deadlines.

Q: Can I withdraw cash during a banking holiday?

A: ATMs are typically available for cash withdrawals even when banks are closed. However, some ATMs may have limited cash availability during holidays.

Q: What happens to loan payments due on a banking holiday?

A: Loan payments due on a banking holiday are typically due on the next business day. However, it’s best to contact your lender to confirm their specific policy.

Q: Are there any exceptions to banking holiday closures?

A: Some banks may offer limited services on specific holidays, particularly for essential transactions. It’s crucial to check with your bank for their specific policies and exceptions.

Tips for Navigating Banking Holidays:

- Check Bank Website: Regularly check your bank’s website for updates regarding holiday hours and potential service disruptions.

- Utilize Digital Services: Embrace online and mobile banking for greater flexibility and access to financial services during holidays.

- Plan Ahead: Plan your financial transactions, including payments and deposits, to avoid last-minute delays.

- Contact Your Bank: If you have questions or concerns regarding specific transactions or services during holidays, contact your bank directly.

Conclusion:

Understanding US banking holidays in 2025 is crucial for navigating financial transactions effectively. By recognizing the dates and potential impacts of these closures, individuals can plan their financial activities strategically, minimizing inconvenience and ensuring smooth operations. The increasing reliance on digital banking platforms further enhances financial flexibility during holidays, offering convenient alternatives for managing finances. By staying informed and utilizing available resources, individuals can confidently navigate the financial landscape throughout the year, even during periods of banking closures.

Closure

Thus, we hope this article has provided valuable insights into Navigating US Banking Holidays in 2025: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!